GCOM – Mortgage Portfolio Analysis – As of September 30, 2023

“Relentlessly strive for the best; as only the virtuous ones can bear the utmost burden”. We relentlessly pursue the principles of honesty and trust, we value our shareholders, borrowers, and our dedicated professional employees.

Since its establishment in 2012, Gentai has strategically planned a series of funds to gain market share in the Canadian mortgage market and offer investors various investment options based on proper asset allocation strategies to achieve long-term wealth creation. The Gentai Commercial Mortgage Fund (GCOM) aims to invest in mortgage investments to provide stable income to investors while preserving their invested capital. The GCOM will focus on investing in commercial mortgages only, with a mandate for capital protection and monthly distribution. This diversified pool of commercial mortgages will be mainly concentrated in British Columbia, Alberta, and Ontario. The Trust’s objective is to provide short-term structured financing solutions to commercial real estate investors by making prudent investments in mortgages that are secured by commercial real property in Canada, including retail, office, industrial, and construction properties, as well as residential properties consisting of five or more units.

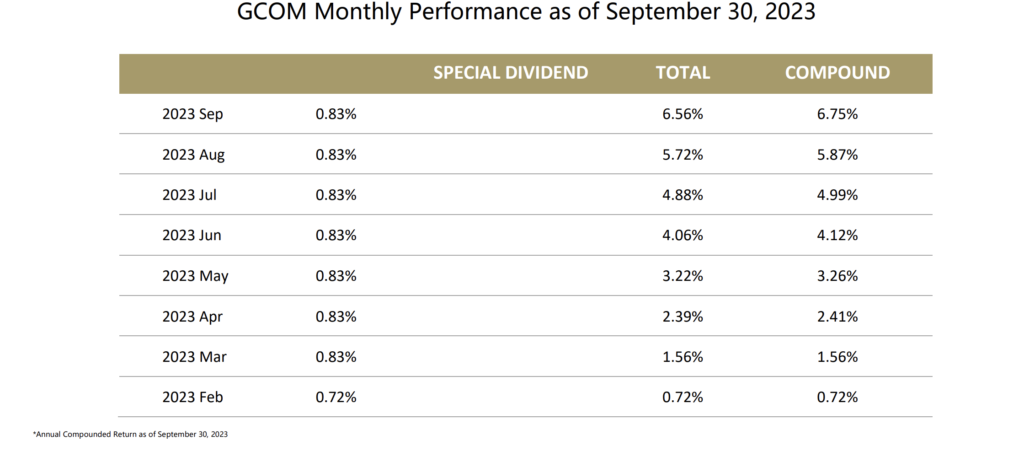

GCOM was created to be an essential part of a well-diversified investment solution for investors. Despite facing significant challenges in the past year, including global economic uncertainty, rising energy and food prices, mounting inflation, and the lingering impact of COVID-19, we launched GCOM in January 2023. As of September 30, 2023, GCOM’s assets under management (AUM) reached 33.85 million dollars, with a mortgage portfolio of 30.97 million dollars. We are pleased to announce that we have successfully distributed returns according to our new target rates of 10% simple interest and 10.47% compound interest, that was set in March.

Highlights for the quarter

Highlights for the quarter

- Mortgage portfolio of $30.97M

- The loan portfolio has an average loan-to-value (LTV) of 63%

- High-quality mortgage investment portfolio

GCOM – Mortgage Portfolio Analysis – As of September 30, 2023

By Mortgage Loan-to-Value Ratio (LTV):

- As of March 31st, 2023, the average loan-to-value (LTV) is 63%

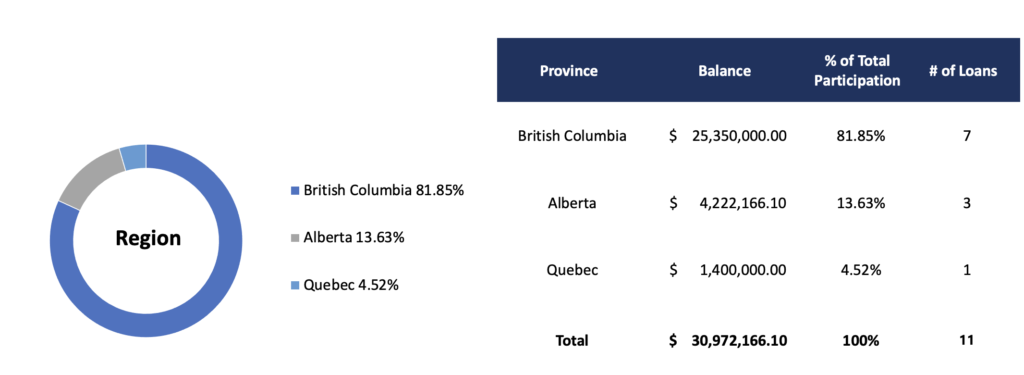

By Geographic Location:

By Mortgage Type:

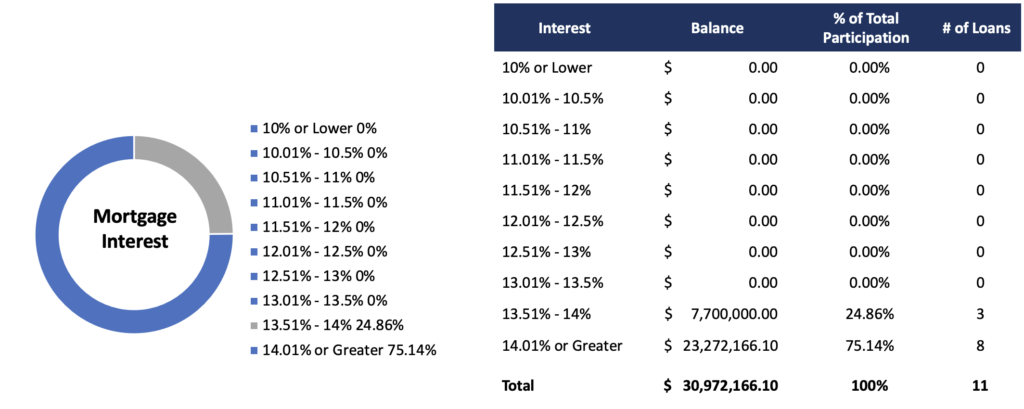

By Mortgage Interest Rate:

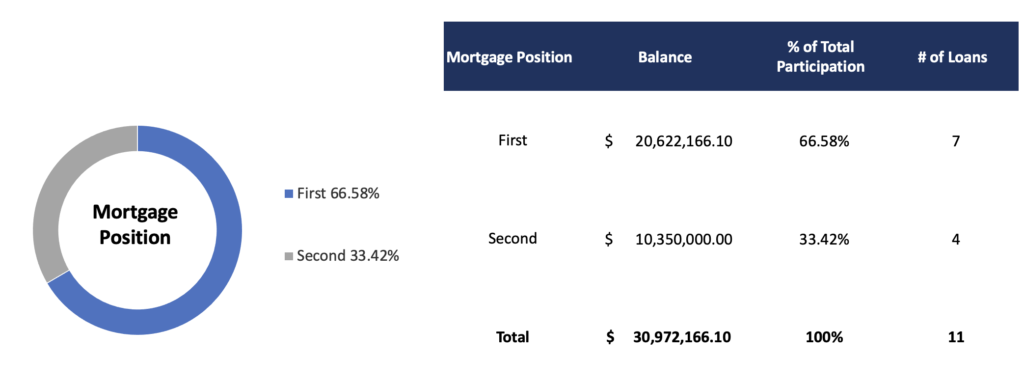

By Mortgage Position:

* There is no guarantee of performance. Past performance may not be repeated.

We wish to thank you for being our investors and giving us your trust and support. It is our sincere hope that you and your families stay safe in these difficult times. It is our duty and pleasure to provide you with a performance that gives you peace of mind and stability in your investments.

Gentai Capital Corporation (Vancouver)

#200 – 3600 No. 3 Road,

Richmond BC V6X 2C1

F: 604.630.7266

Toll-Free: 1-855-982-6699

Lending Department Office

Unit 805, North Tower, International Trade Centre,

8400 West Road, Richmond BC V6X 0S7

Toronto Office

#228-505 Highway 7 E

Follow us on social media: