GMIC – Mortgage Portfolio Analysis – As of December 31, 2023

“Relentlessly strive for the best; as only the virtuous ones can bear the utmost burden”. We relentlessly pursue the principles of honesty and trust, we value our shareholders, borrowers, and our dedicated professional employees.

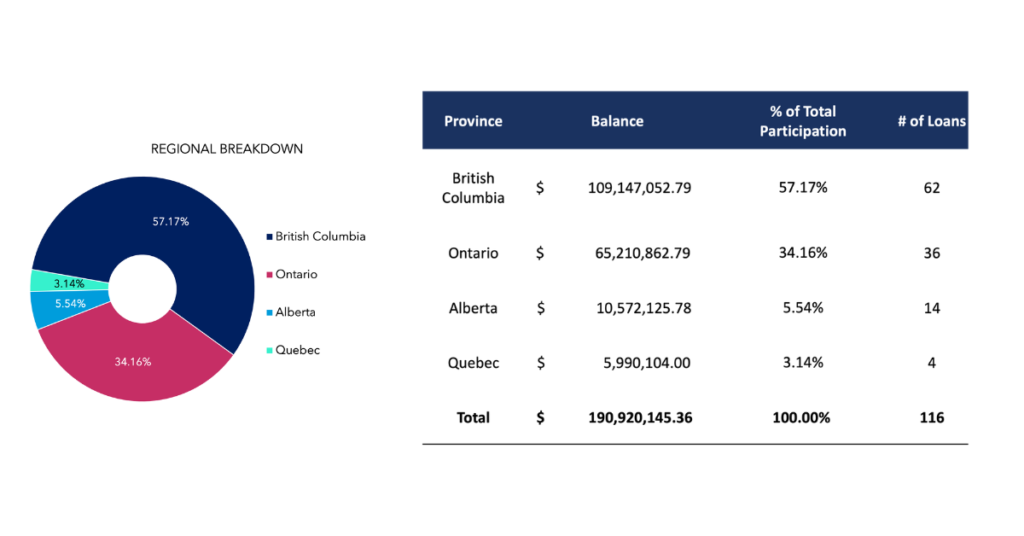

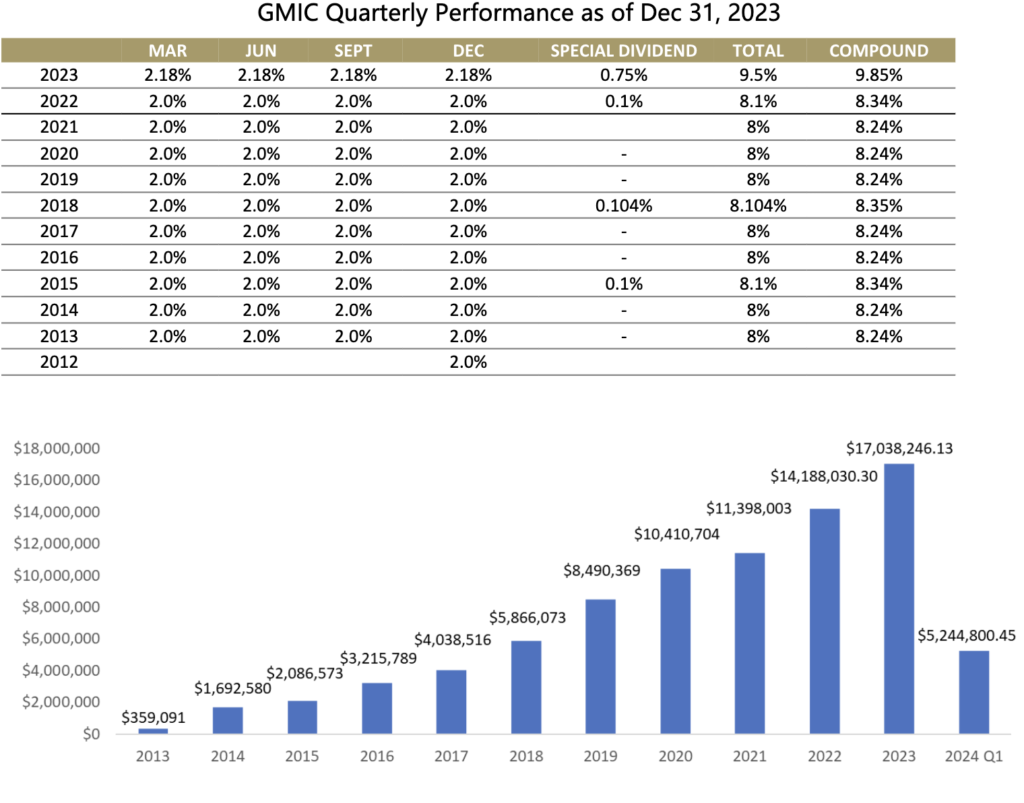

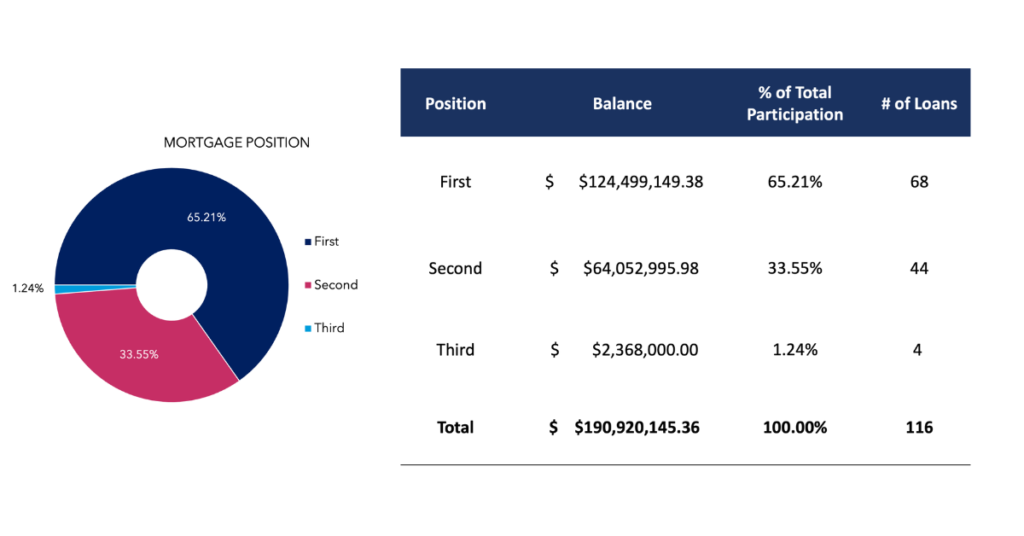

Since our company’s founding eleven years and three months ago, we have invested in 732 mortgages in total with a cumulative loan amount of $952.02 million, yielding a cumulative dividend distribution of $ 84,028,774.31 made up of 45 regular dividends and 4 special dividends. Our mortgage portfolio currently stands at $190.92 million, with assets under management of $207.07 million. Our mortgage portfolio has historically been focused on British Columbia but has also been diversified across Alberta, Ontario, and Quebec.

Despite significant economic challenges in recent years, including global economic uncertainties, rising energy and food prices, increased inflation rates, and the impact of ongoing central bank interest rate hikes, GMIC continues to provide investors with stable quarterly dividends according to the target return rate. In the fiscal year 2023, GMIC distributed a special dividend of 0.75% to investors. Now, GMIC is pleased to announce that it will pay dividends in the first quarter of the 2024 fiscal year at the target return rate, with a simple interest of 8.75% (compounded 9.04%).

As part of our long-term strategy, we launched Gentai residential mortgage fund (GREF) in June 2021 and Gentai commercial mortgage fund (GCOM) in January 2023. The successful launch of GREF and GCOM represents the completion of our strategy of offering a complete investment product line in the mortgage market in Canada. By offering both residential and commercial mortgage funds, we are now able to cater to the needs of a broader range of investors, providing them with different investment options that suit their specific goals and risk profiles.

Highlights for the quarter

Highlights for the quarter

- Mortgage portfolio of $190.92M

- The loan portfolio has an average loan-to-value (LTV) of 64%

- High-quality mortgage investment portfolio

GMIC – Mortgage Portfolio Analysis – As of December 31, 2023

By Mortgage Loan-to-Value Ratio (LTV):

- As of December 31, 2023, the average loan-to-value (LTV) is 64%.

By Geographic Location:

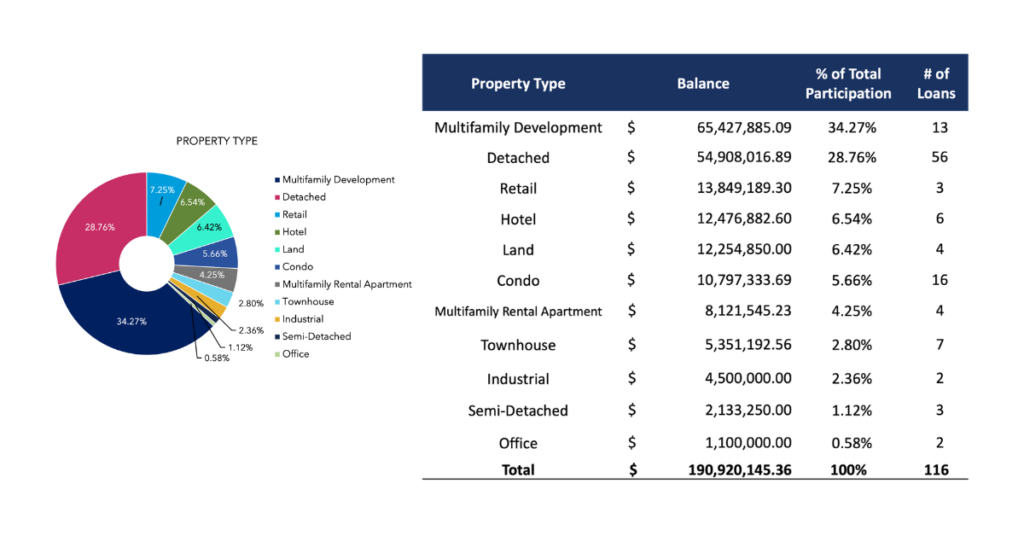

By Mortgage Type:

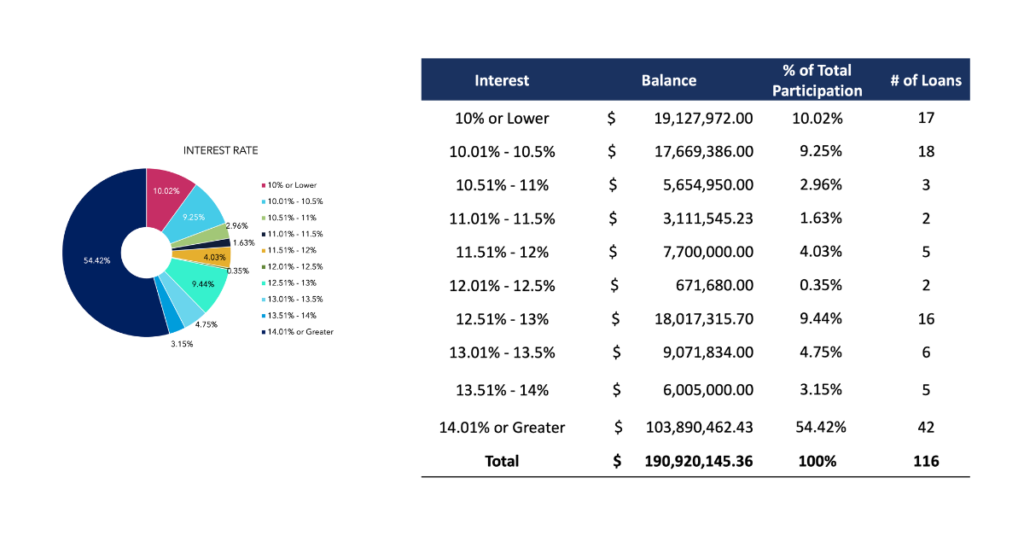

By Mortgage Interest Rate:

By Mortgage Position:

* There is no guarantee of performance. Past performance may not be repeated.

Gentai Capital Corporation (Vancouver)

#200 – 3600 No. 3 Road,

Richmond BC V6X 2C1

F: 604.630.7266

Toll-Free: 1-855-982-6699

Lending Department Office

Unit 805, North Tower, International Trade Centre,

8400 West Road, Richmond BC V6X 0S7

Toronto Office

#228-505 Highway 7 E

Follow us on social media: