Since the company was founded 8 years ago, we have been achieving a stable and high return (8.24% – 8.35%). We have invested in 387 mortgages in total with a cumulative loan amount of $472.64 million, yielding a cumulative dividend distribution of $39,074,133 made up of 32 regular dividends and 2 special dividends. We continue to gain the trust of more and more investors every month. GMIC endeavors to build a national presence managing assets of $160.77 million and a mortgage portfolio of $136.19 million for 486 shareholders. Gentai group has 31 full-time employees including a management team of 6 seasoned professionals.

COVID-19 has significantly impacted the investment market, and many investors suffered significant losses. In contrast, GMIC paid a stable dividend of 2% in the fourth quarter of 2020. This once again shows investors of the importance of asset allocation, and also confirm the value of GMIC as an alternative investment product.

As of September 30th, 2020, Gentai Capital has managed GMIC for over 8 years, funding 387 mortgages totaling $472.64 million, successfully achieving the target annual return of 8.24%*, and consistently paying dividends (32 dividends + 2 special distribution) with total dividends paid of $ 39,074,133.

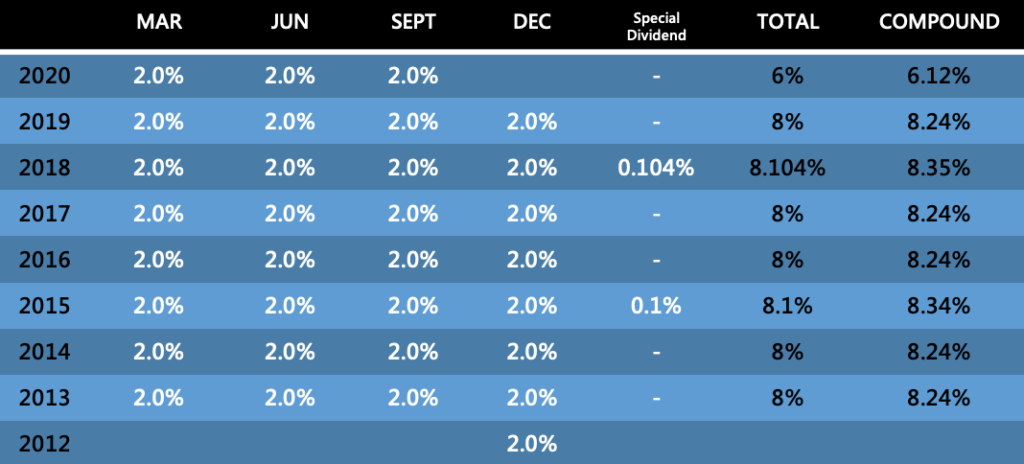

GMIC Performance (Quarterly) – As of Sept. 30th, 2020

Highlights for the quarter

- Record mortgage interest income of $3.43 million.

- Regular quarterly dividend continues at $0.02 per quarter ($0.08 annualized), plus a special dividend at year-end, as determined by the board of directors.

- The loan portfolio has an average loan-to-value (LTV) of 53.10%.

- Mortgage portfolio of $136.19 million.

- Continued focus on low-risk real estate sectors

GMIC – Mortgage Portfolio Analysis – As of Sept. 30th, 2020

By Mortgage Loan-to-Value Ratio (LTV):

- As of Sep. 30th, 2020, the average loan-to-value (LTV) is 53.10%.

- Since the second quarter of 2016, the maximum loan in proportion to the subject property’s appraisal value has been reduced from 75% to 65% in response to uncertainties in the real estate markets.

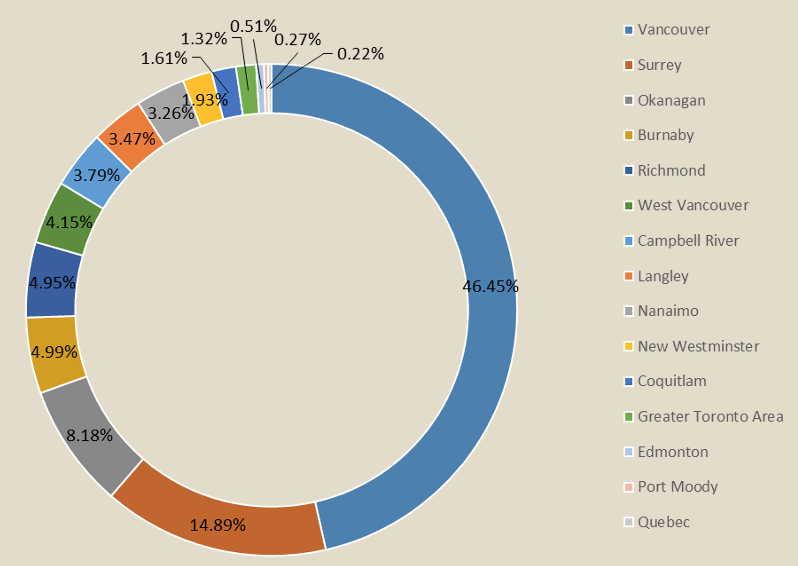

By Geographic Location:

- Mortgage properties are concentrated in central urban areas; Vancouver, Surrey accounted for the top two.

- Central urban areas are preferred locations where the real estate market is active and less volatile.

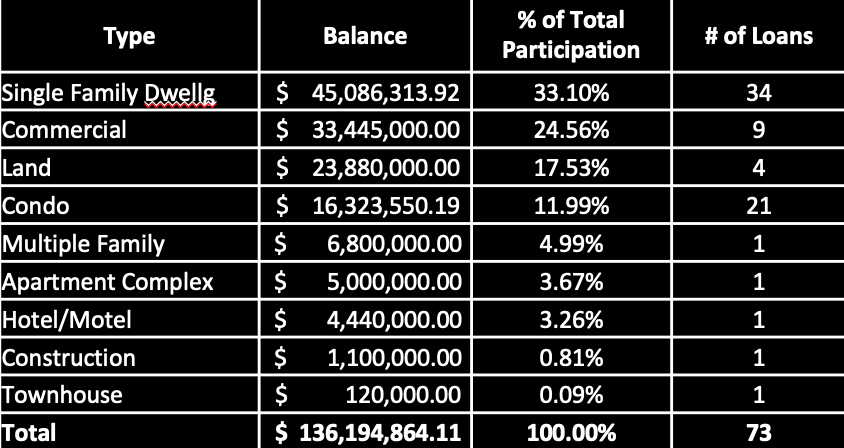

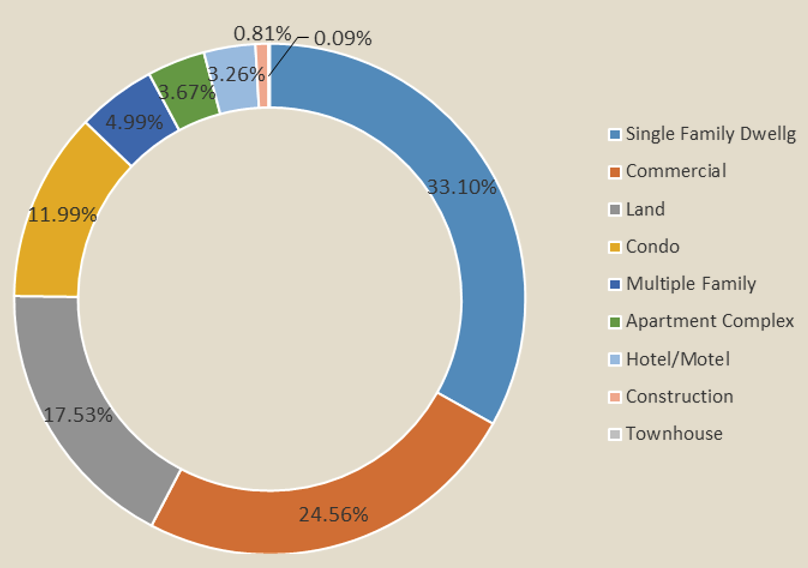

By Mortgage Type:

- Mortgage types include single houses, townhouses, condos, commercial, land, and construction. Single houses consisted of 33.10% of the mortgage portfolio. Diversification in investments is expected to lessen the risks involved.

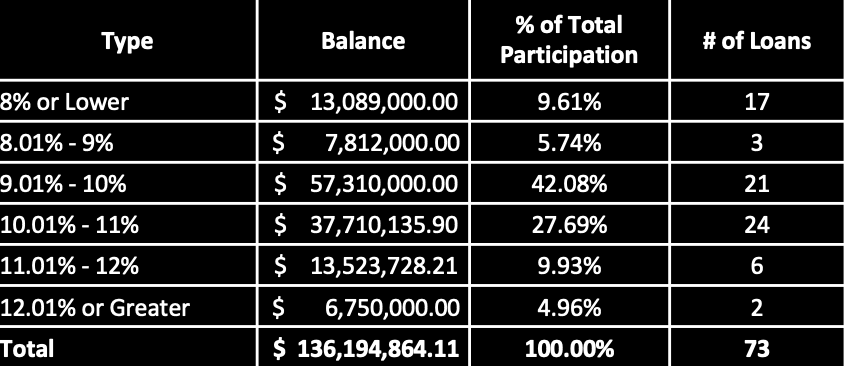

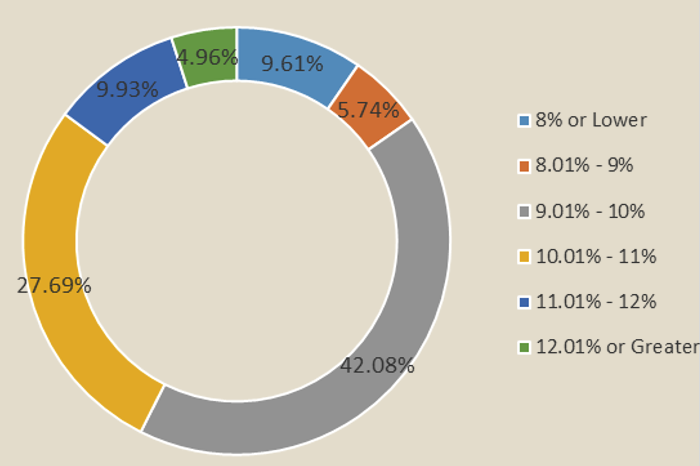

By Mortgage Interest Rate:

- As of Sep. 30th, 2020, the average mortgage interest rate is 10.18%.

- Gentai Capital applies strict control in risk management throughout the loan process. Due to the strict and robust lending policy, Gentai Capital has not only consistently achieved an 8.24%* return for investors in seven years and nine months but also strictly controlled the potential risks involved to generate such a high rate of return.

* There is no guarantee of performance. Past performance may not be repeated.

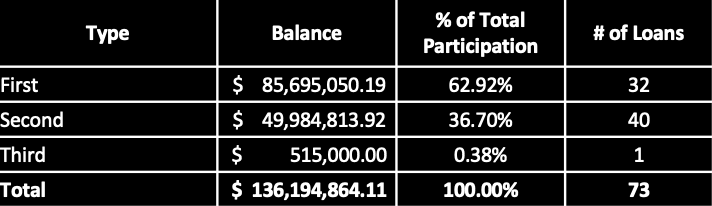

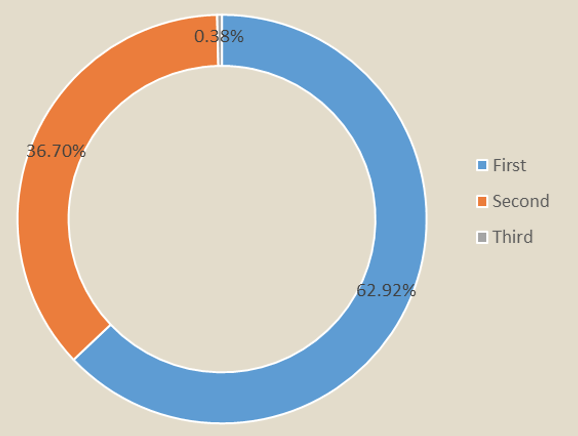

By Mortgage Position:

- First position over 62.92%.

We wish to thank our investors for your trust and support. It is our sincere hope that you and your families stay safe in these usual times. It is our duty and pleasure to provide peace of mind and stability in the form of your investment with us. We look forward to seeing every one of you at our AGM in 2021.