Gentai Residential Mortgage Fund’s investment objectives are capital preservation and strong cash flow through monthly distribution by investing in a diversified mortgage portfolio secured by residential real estate.

Gentai Residential Mortgage Fund

Experience

9 Years and 9 months

of Successful Mortgage Investing

TTM Yield

6.17%

Per Annum

Value

$100 Million

Total Mortgage Portfolio

Ratio

70%

weighted average

loan-to-value

Fund Summary

Open-ended Pooled Mortgage Fund

Offering Memorandum, Accredited Investors

RRSP, TFSA

Monthly

$1.00

6 Months After Issuance

June 1, 2021

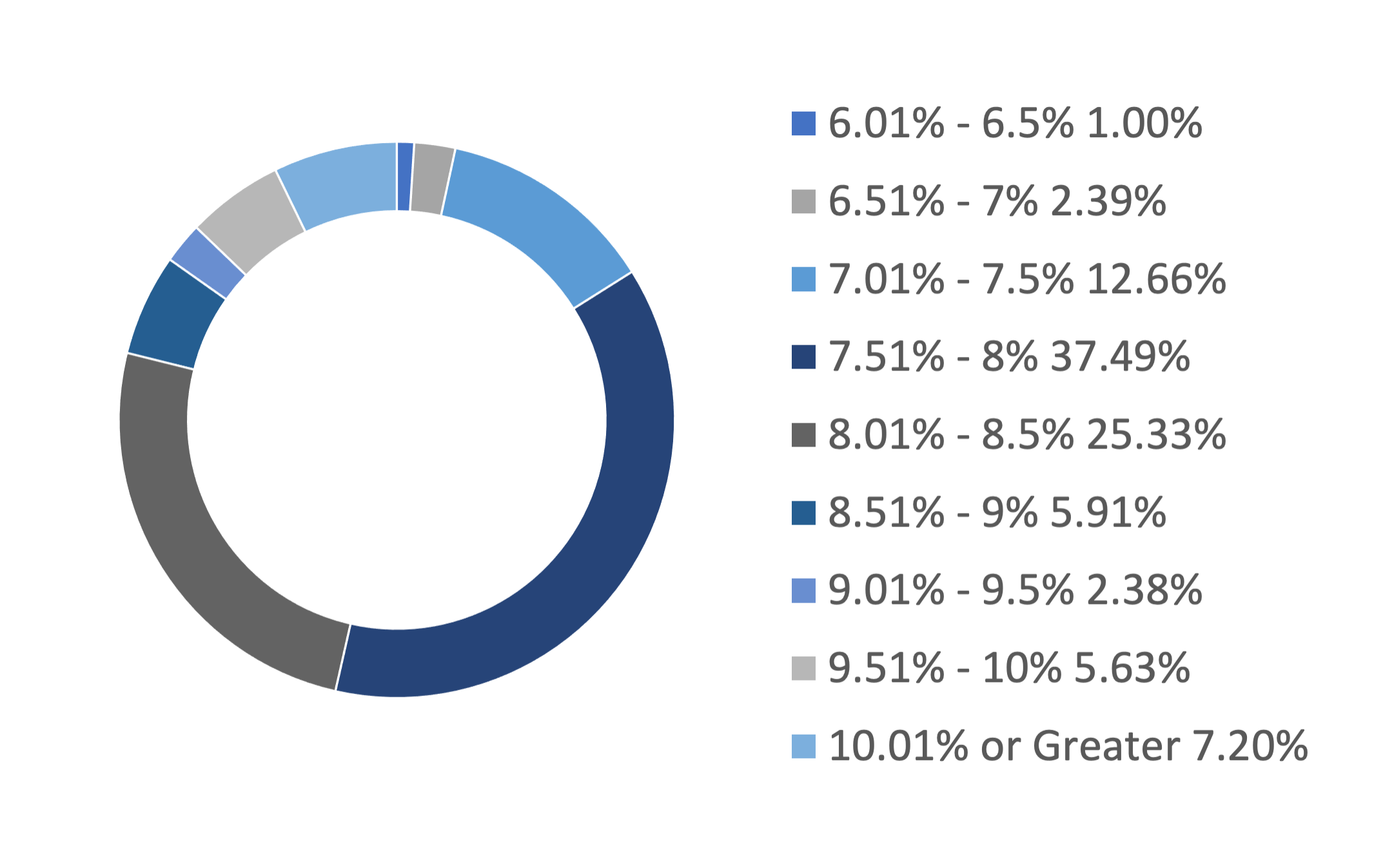

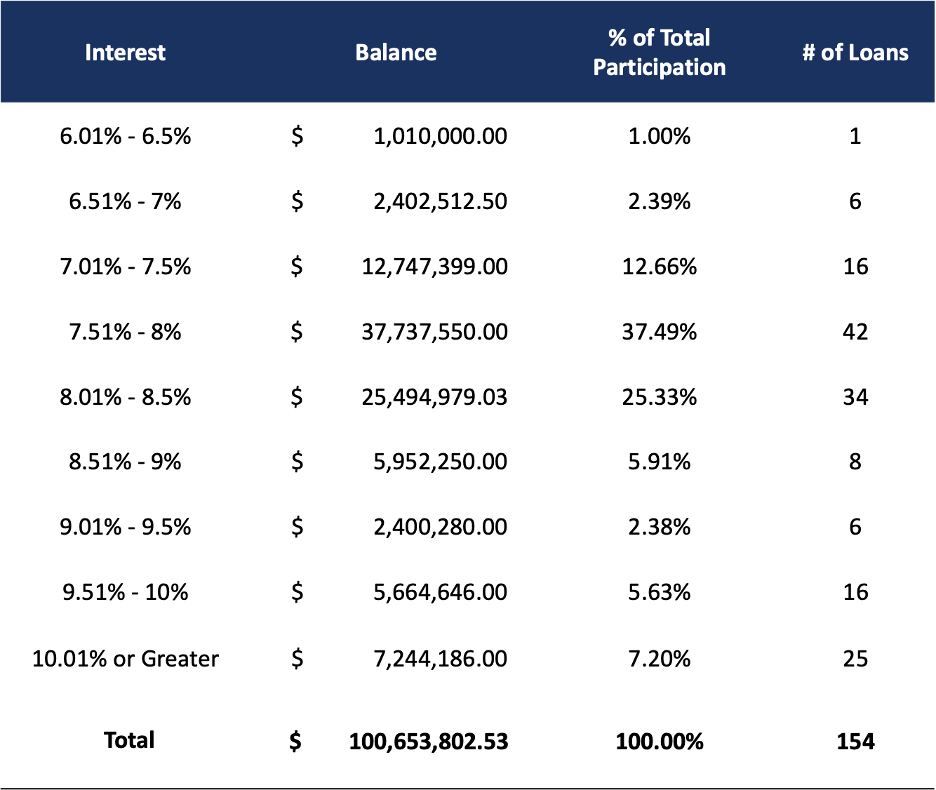

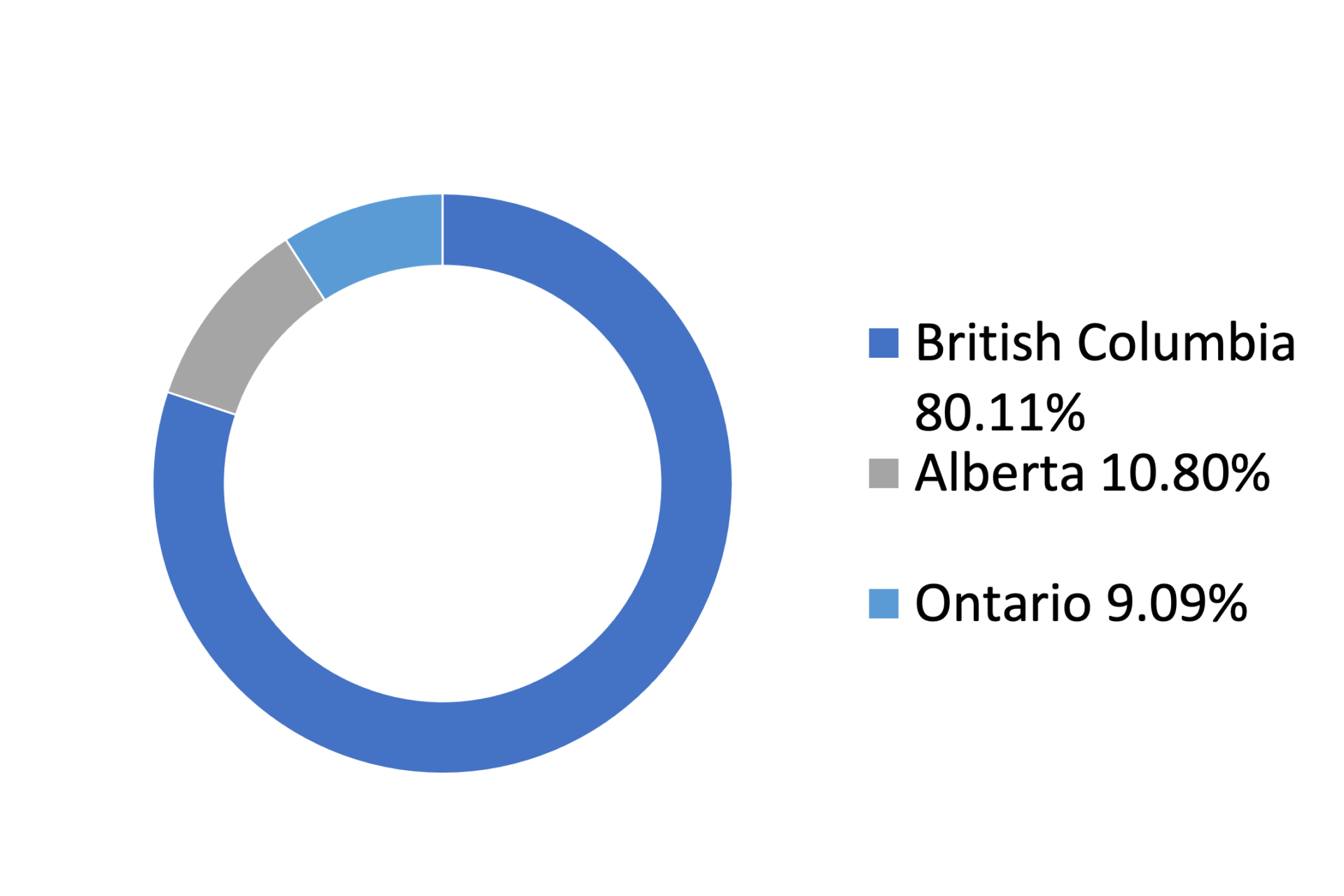

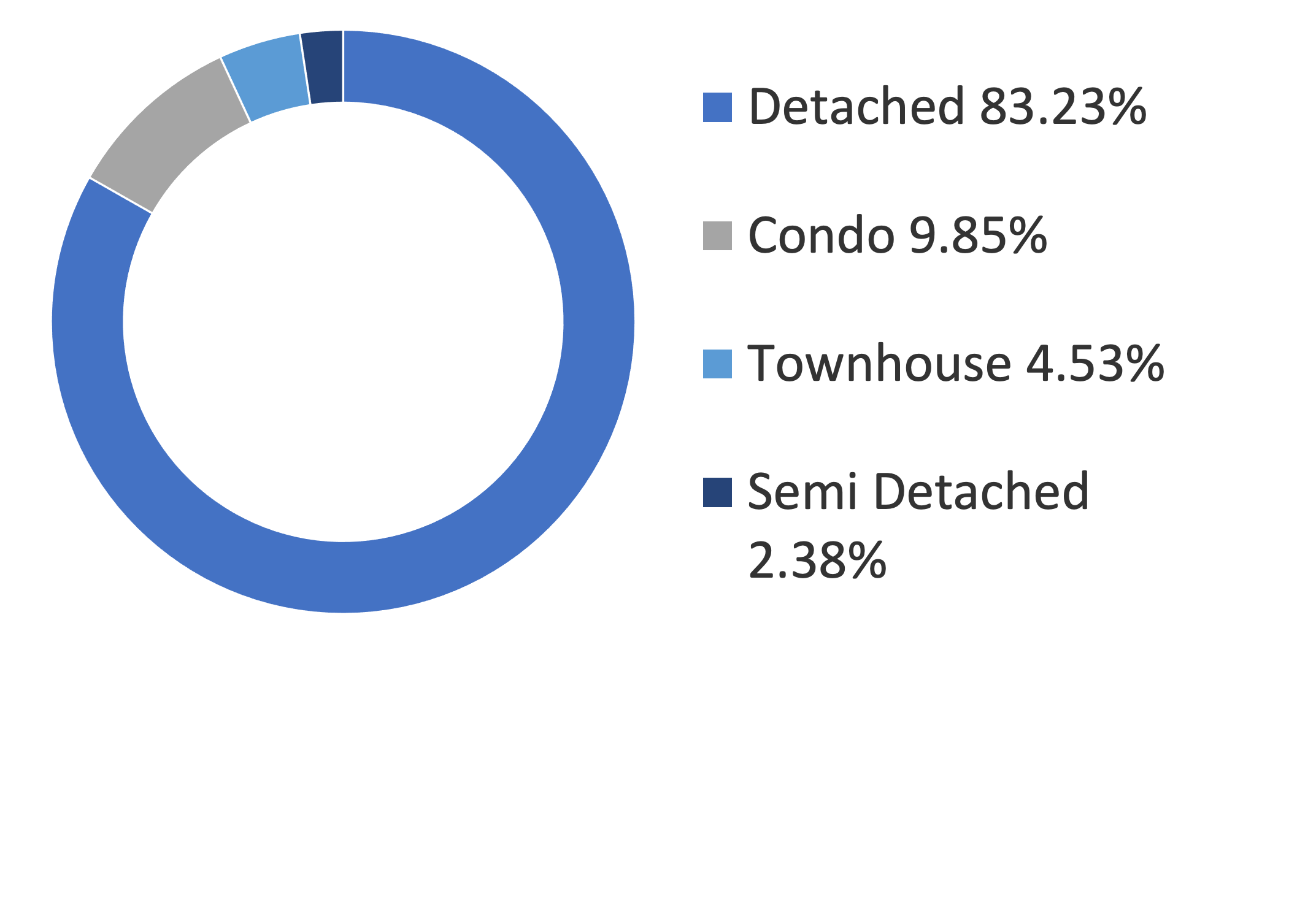

Mortgage Portfolio Highlights

— June 30, 2022

$100 Million

218

8.23%

70%

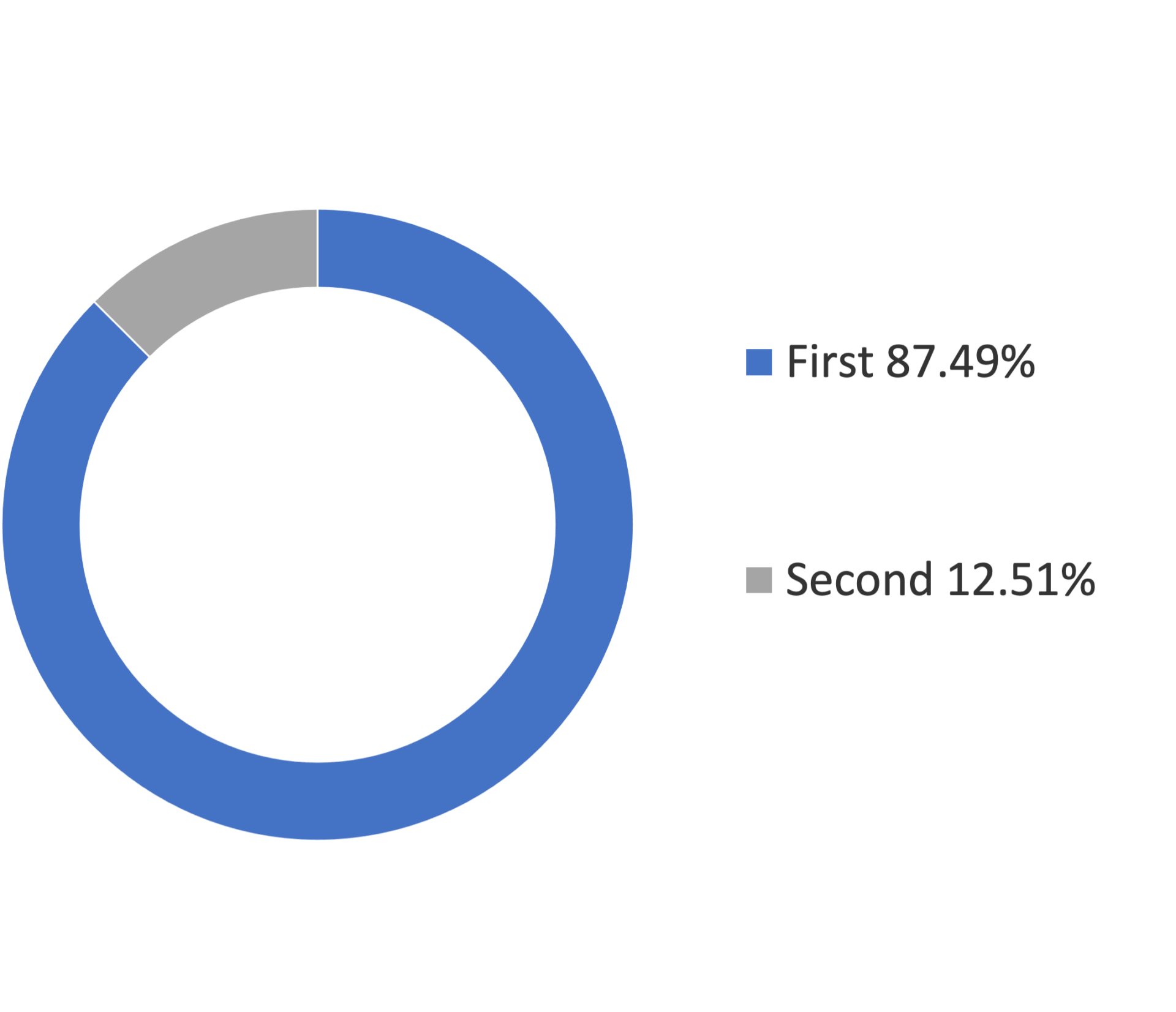

87.49%

12.15%

Statistics — Mortgages By

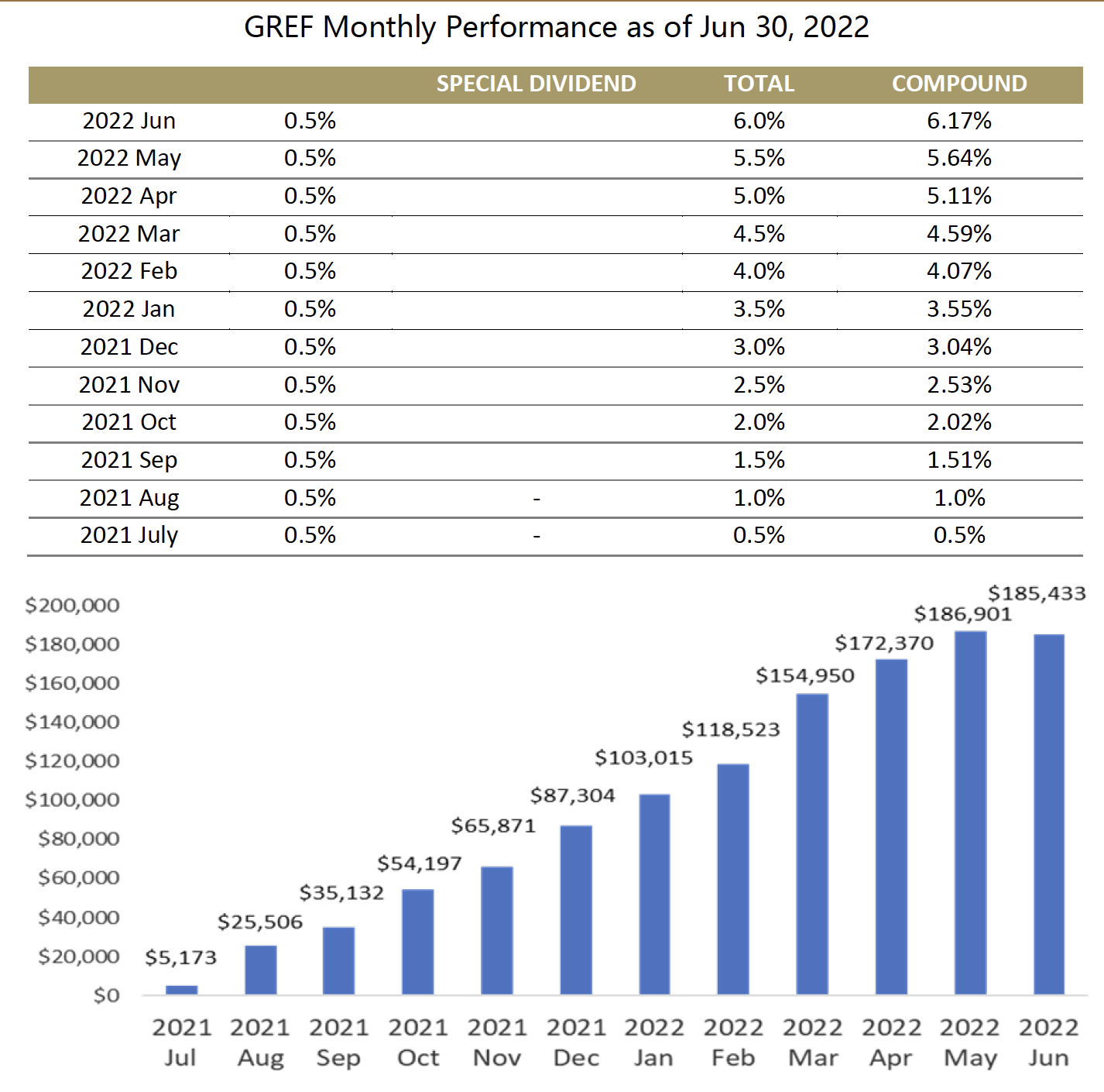

GREF Performance

Since the trust was founded on June 1st,2021, we have invested in 128 mortgages in total with a cumulative loan amount of $138.97 million, yielding a cumulative dividend distribution of $ 1,194,375 made up of 12 regular dividends. We continue to gain the trust of more and more investors every month. GREF endeavours to build a national presence managing assets of $139 million and a mortgage portfolio of $100 million as of June 30, 2022.

Start Your Investment Journey With Us

To explore the benefits of investing in GMIC, please contact:

Gentai Asset Management Corporation

Gentai Asset Management Corporation

Office Direct: 604-558-8098

Email: [email protected]

Or submit your questions below to connect with one of our representatives: