“Relentlessly strive for the best; as only the virtuous ones can bear the utmost burden”. We relentlessly pursue the principles of honesty and trust, we value our shareholders, borrowers, and our dedicated professional employees.

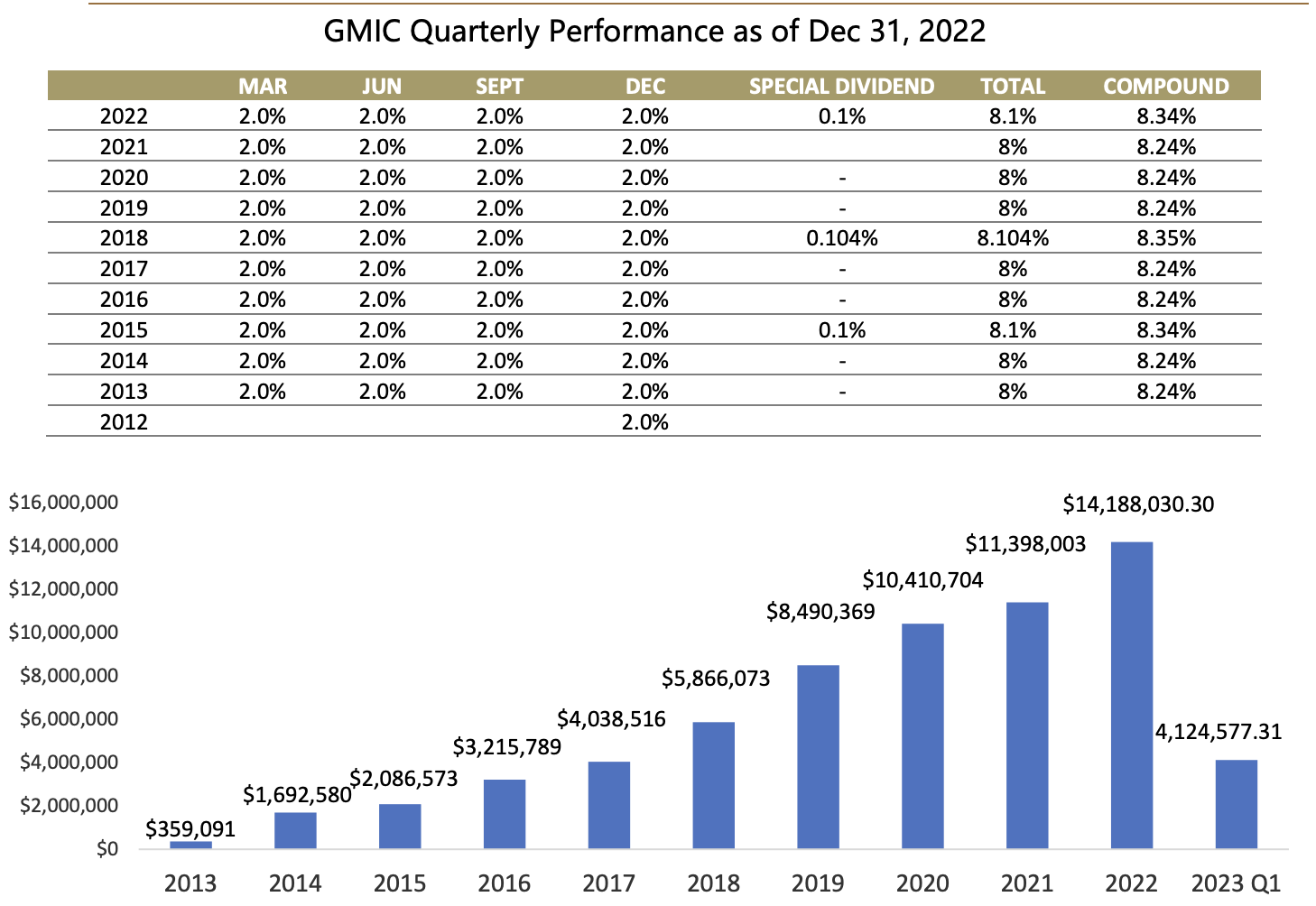

Since the company was founded ten years and three months ago, we have been achieving stable and high returns (8.24% – 8.35%). We have invested in 653 mortgages in total with a cumulative loan amount of $857.99 million, yielding a cumulative dividend distribution of $ 66,077,035 made up of 41 regular dividends and 3 special dividends. We continue to gain the trust of more and more investors every month. GMIC endeavors to build a national presence managing assets of $239.52 million and a mortgage portfolio of $225.19 million for 679 shareholders.

COVID-19, which emerged in late December 2019, directly impacted the investment markets with a dramatic decline and caused many investors to suffer significant losses. In contrast, GMIC continued to pay a stable dividend of 2% in each quarter of 2020, 2021 and 2022. We are now happy to announce that we will distribute the targeted dividend for Q1 of our 2023 fiscal year with a 0.1% special dividend declared, achieving 8.10% simple interest and 8.34% compound interest return for investors. This once again is a reminder of the importance of asset allocation and verifies the value of GMIC as an alternative investment product.

Gentai group has 33 full-time employees including a management team of 6 seasoned professionals. We are glad to announce that a new fund was launched in June 2021. Since Gentai’s inception in 2012, a series of funds have been strategically planned to not only gain market share in the increasing Canadian mortgage market but also give investors options to choose investments based on proper asset allocation strategies with an aim to achieve long-term wealth creation. The Gentai Residential Mortgage Fund (GREF) will deploy investments into residential mortgages only, with a mandate for capital preservation, and a targeted yield of 5%-7%. This diversified pool of residential mortgages will be concentrated in British Columbia, Alberta, and Ontario. As of Dec 31, 2022, the total mortgage portfolio is $95.91 million.Please contact a Dealing Representative for details.

Highlights for the quarter

- Record mortgage interest income of $7.4 million

- Mortgage portfolio of $225 million

- The loan portfolio has an average loan-to-value (LTV) of 62%

- High-quality mortgage investment portfolio

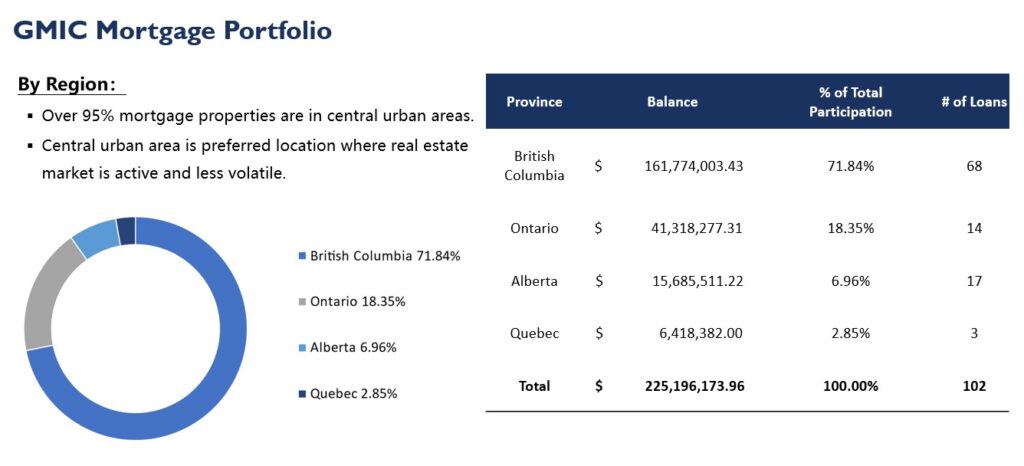

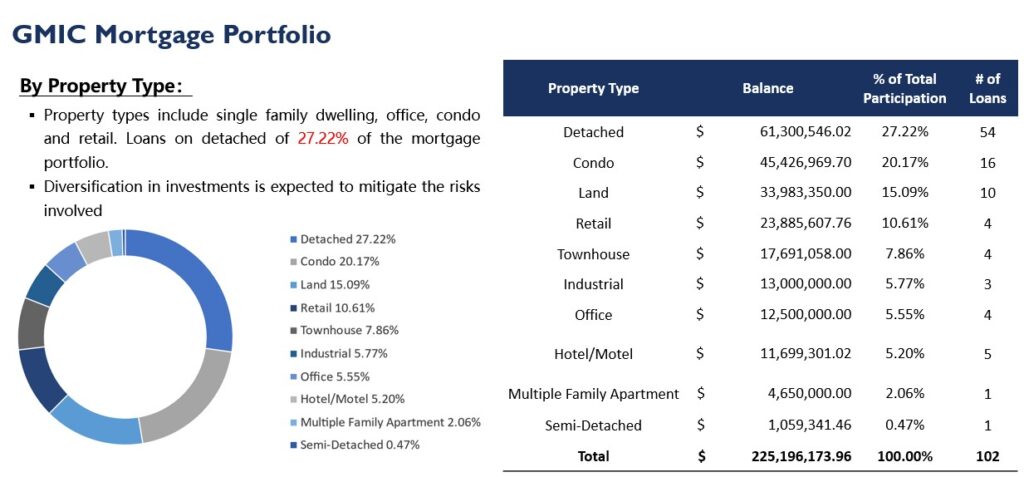

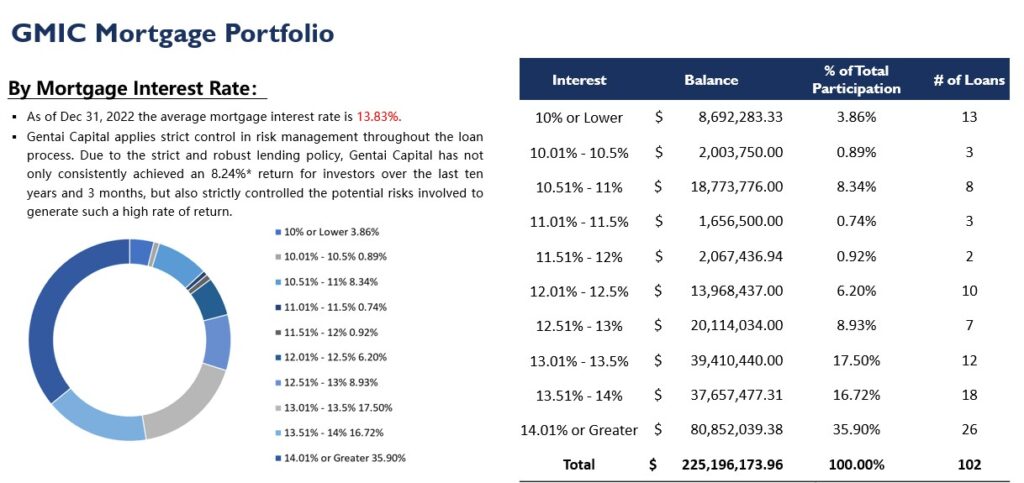

GMIC – Mortgage Portfolio Analysis – As of December 31, 2022

By Mortgage Loan-to-Value Ratio (LTV):

- As of December 31st, 2022, the average loan-to-value (LTV) is 62%.

By Geographic Location:

By Mortgage Type:

By Mortgage Type:

By Mortgage Interest Rate:

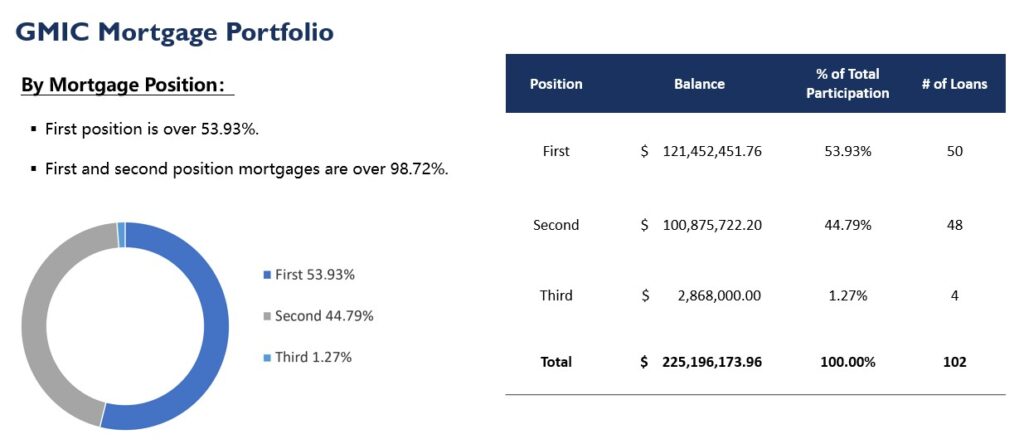

By Mortgage Position:

* There is no guarantee of performance. Past performance may not be repeated.

We wish to thank you for being our investors and giving us your trust and support. It is our sincere hope that you and your families stay safe in these difficult times. It is our duty and pleasure to provide you with a performance that gives you peace of mind and stability in your investments.

Gentai Capital Corporation (Vancouver)

#200 – 3600 No. 3 Road,

Richmond BC V6X 2C1

F: 604.630.7266

Toll-Free: 1-855-982-6699

Lending Department Office

Unit 805, North Tower, International Trade Centre,

8400 West Road, Richmond BC V6X 0S7

Toronto Office

#228-505 Highway 7 E

Follow us on social media: